Assam Tea Industry in Distress: ITA Calls for Immediate Intervention

The Assam tea industry, which accounts for over 50% of India’s total tea production, is facing an unprecedented crisis that threatens the livelihoods of millions and the sustainability of one of the country’s most iconic industries. The Indian Tea Association (ITA) has issued urgent calls for immediate government intervention, warning that the industry faces an “existential threat” due to multiple converging challenges.

Production Crisis and Climate Impact

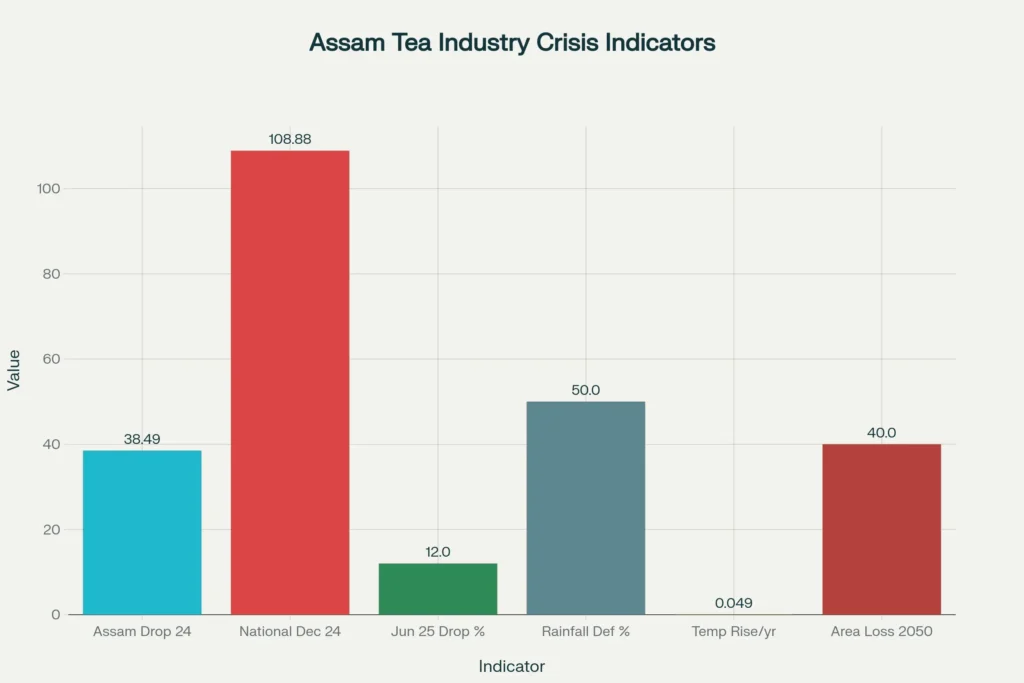

Tea production in Assam has declined dramatically, with the state experiencing a 38.49 million kg drop in 2024 compared to 2023. This represents a significant portion of the overall 108.88 million kg national decline in tea production during the same period. The crisis has intensified in 2025, with June production falling by 12% compared to the previous year, attributed to a 50% rainfall deficit and extreme weather conditions.

Climate change has emerged as a primary driver of production losses. Daily temperatures have risen by 2°C on average, with extreme conditions reaching 36°C during the day and dropping to 26°C at night. The temperature fluctuation of nearly 10 degrees creates an environment completely unsuitable for healthy tea cultivation. From 1990 to 2019, maximum temperatures in Assam increased by 0.049 degrees Celsius annually, while rainfall declined by an average of 10.77 million millimeters.

Research by Tata Consumer Products warns that climate change could reduce tea-growing areas in Assam by up to 40% by 2050 without urgent adaptation measures. The Food and Agriculture Organization (FAO) has similarly cautioned about potential yield losses of up to 40% in Northeast India if climate adaptation strategies are not implemented.

Market Distortions and Price Collapse

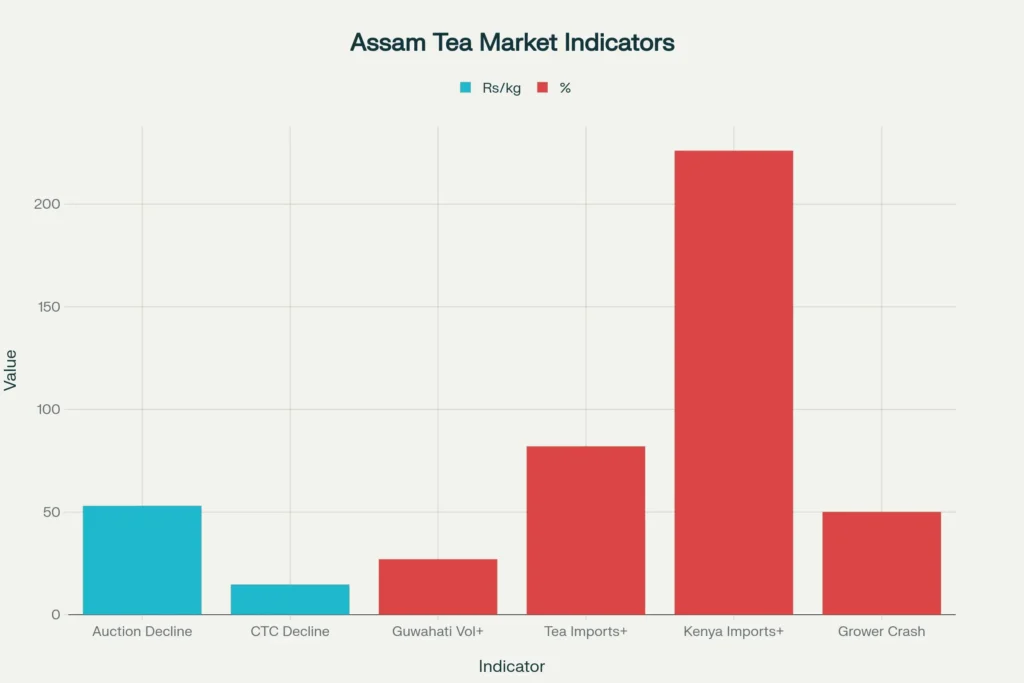

Auction prices have plummeted significantly, with North India’s three major tea auction centers—Kolkata, Guwahati, and Siliguri—witnessing price declines ranging from Rs 32 to Rs 74 per kg during mid-July to mid-August 2025. The CTC variety, which accounts for about 76% of India’s tea production, has been particularly affected.

Despite increased sales volumes at some auction centers—the Guwahati Tea Auction Centre reported a 27% surge in sales during April-June 2025—average prices for CTC teas declined by Rs 14.68 compared to the previous year. This paradox of higher volumes but lower prices reflects the fundamental supply-demand imbalance plaguing the industry.

Import surge has emerged as a critical factor depressing domestic prices. Tea imports to India increased by 82% in 2024, reaching 44.53 million kg, with Kenya alone accounting for a 226% increase to 17.13 million kg. The first three months of 2025 showed another 117% increase in Kenyan tea imports, effectively neutralizing efforts by producers to stabilize prices despite reduced domestic production.

Wage Crisis and Worker Distress

The wage disparity between Assam tea workers and those in other states remains stark. While the Assam government announced an increase in daily wages for state-run tea garden workers from Rs 220 to Rs 250 effective October 2025, and private gardens pay between Rs 228-251 per day, these amounts fall far short of livable wages.

An Oxfam India study estimated that Assam tea workers need Rs 884 per day to lead a dignified life, nearly four times the current wages. In comparison, tea workers in Kerala earn Rs 301 per day, while those in Tamil Nadu receive Rs 314. The Tea Association estimated that workers should receive realization of at least 50% of production costs, including capital costs, to ensure sustainability.

Small tea growers face particularly severe challenges, with green tea leaf prices crashing from Rs 40 to Rs 20 per kg, forcing many to sell at losses. The price-sharing formula currently in place does not compensate for production costs, leaving small growers without bargaining power in an increasingly difficult market.

Export Challenges and Trade Barriers

The industry faces additional pressure from new US tariffs, with the recent imposition of 50% tariffs on Indian goods likely to impact tea exports significantly. The US market represents 7% of Indian tea exports, importing 17 million kg in 2024, making it a crucial destination for premium Assam and Darjeeling varieties.

India currently ranks fourth globally in tea exports with an 11% market share, trailing behind China, Kenya, and Sri Lanka. The ITA has called for government intervention to ensure a level playing field with competing countries like Sri Lanka and Indonesia, whose governments provide export subsidies and incentives.

ITA’s Four-Point Intervention Plan

The Indian Tea Association has outlined a comprehensive four-point intervention strategy addressing the industry’s most pressing challenges:

- Price Stabilization: The ITA has renewed its demand for a Minimum Sustainable Price (MSP) for made tea, arguing that such a mechanism would ensure cost coverage with reasonable margins and act as a minimum import price to protect against cheap imports.

- Pest Management Support: The association seeks expedited approvals for Acetamiprid and Imidacloprid pesticides and finalization of pending FSSAI notifications for new Maximum Residue Limits. Climate change has exacerbated pest problems, with increased occurrences of red spider mites, thrips, looper caterpillars, and green flies reported across estates.

- Import Regulation: ITA has called for banning duty-free tea imports under Advance Authorization and SEZ schemes, proposing instead that imports be allowed only after payment of full duties, with refunds provided after verifiable exports. The association argues that misuse of these schemes allows cheap imported tea to enter the domestic market illegally.

- Export Incentives: The industry body demands reinstatement of orthodox tea subsidies with higher outlay and consideration for a dedicated freight corridor to reduce shipment costs.

Government Response and Industry Support

The Tea Board of India announced a Rs 664.09 crore project running from 2023-24 to 2025-26, focusing on increasing domestic consumption, better price realization, and exports through a field-to-cups approach. The scheme includes support for replantation, nursery assistance, setting up mini tea units, organic certification, and international brand promotion.

However, former Tea Board Chairman Prabhat Bezboruah expressed skepticism, noting that the Board still owes over Rs 200 crores in approved subsidy claims to the industry, raising questions about implementation effectiveness.

Parliamentary recognition has provided some hope, with the Parliamentary Standing Committee on Commerce endorsing several ITA submissions in its 194th Report, including recommendations for curbing low-quality imports, reviewing trade agreements, and ensuring export incentives comparable to competing countries.

Economic and Social Impact

The crisis extends beyond production statistics to affect millions of workers across Assam’s 850+ registered tea gardens. The industry employs between 8-12 lakh workers, making it one of the largest formal sector employers in the region. Many workers face near-starvation conditions, with wages barely sufficient for basic sustenance.

Tea estate closures compound the crisis, with workers from closed gardens like Dooteriah, Kalej Valley, and Peshok in Darjeeling engaging in alternative livelihood activities. MGNREGA absorption provides only 40-60 days of work annually, with average annual incomes ranging from Rs 8,080 to Rs 12,120.

The financial sustainability of tea estates remains under severe threat, with production costs surging by 20% over the past three years while market prices stagnated. Gas costs alone increased by 300%, from Rs 6 to Rs 20 per kg of tea produced.

Long-term Sustainability Concerns

Climate projections paint a grim picture for the industry’s future. Research indicates that tea-growing regions face severe susceptibility to changing climate by 2050 unless urgent adaptation measures are adopted. Both minimum and maximum temperatures are expected to increase across all major tea-growing regions, while rainfall patterns will shift with reduced precipitation in the first quarter and increased monsoonal rainfall.

The seasonality of precipitation has the highest influence on tea growth suitability, with models showing drastic reductions in suitability across entire tea-growing regions by 2050. This necessitates immediate investment in climate adaptation technologies and drought-resistant cultivation practices.

Conclusion

The Assam tea industry stands at a critical crossroads, facing an existential crisis that demands immediate and comprehensive intervention. The ITA’s call for urgent government action reflects the industry’s desperate need for policy support to address price volatility, import regulation, pest management, and export competitiveness.

Without swift action on multiple fronts—implementing minimum sustainable pricing, regulating cheap imports, supporting climate adaptation, and ensuring fair wages—the industry that has been synonymous with Assam’s identity and economic backbone for over two centuries faces an uncertain future. The sustainability of livelihoods for millions of workers and the preservation of India’s tea heritage hang in the balance, making immediate intervention not just economically necessary but morally imperative.

The convergence of climate change, market distortions, and structural challenges requires a coordinated response from government, industry stakeholders, and international partners to ensure the long-term viability of Assam’s tea sector and protect the interests of all stakeholders in this vital industry.

India’s Tea Exports to UAE, Iran, and Iraq in Danger from Strait of Hormuz Problems

India sends a lot of tea to countries like UAE, Iran, and...

Tocklai Tea Research Center launches New Healthy Green Tea Powder with 75% Less Caffeine

The Tea Research Association (TRA) Tocklai in Assam has launched a special new green...

Assam Tea Workers Celebrate 20% Durga Puja Bonus from 7 Major Tea Estates

Breaking News: Tea workers across Assam have significant cause for celebration as 90...

Karam Festival: A Celebration of Nature, Harvest, and Tribal Heritage

The Karam Festival, also known as Karma Puja, is one of India’s most...

Leave a comment